CHAMPAGNE BULLETIN MAY 2024

Hello and welcome to the first Champagne Bulletin for a few months. I hope you’ll forgive the gap but there has been little of real note to tell you about. Recently however a few articles have have caught my attention that i'd like to share with you.

Volume versus value

The figures for champagne shipment volumes in the year 2023 were released several weeks ago and showed a total of 299 million bottles - a drop of 8.2% compared to the 326 million shipped in 2022

Many figures in Champagne welcome these figures and called them a return to normality after three chaotic years between 2020 and 2022 which saw dramatic falls in shipments followed by equally sensational, and probably unsustainable, increases.

The drop in shipments in 2023 was felt across all three recognised producer categories but to a varying extent: Maisons (the big brands): down 8.2 % vs 2022, Cooperatives (down 16.1%) and Vignerons (the smaller independent producers): down just 2.5%

This might seem to be disappointing news for all concerned but when one looks at the value of those shipments, rather than the volume, the picture is quite different:

For the Maisons, the value of their shipments went up by 10.7 % to reach an average price per bottle of 23.41 euros.

For the Cooperatives, the same figures were: value up by 12.5% and an average price per bottle of 16.30 euros

And for the Vignerons the figures were: value up 7.8% with an average price per bottle of 16.25 euros.

These average prices are useful to anyone looking to purchase champagne – for example, anyone contemplating a private brand – but when looking at these average prices, please bear in mind that:

a) they are averages that inevitably hide large variations

b) they are ex cellars prices, not retail prices which will be several multiples high – typically 3 or 4 x higher depending on the distribution structure and taxation regime in the country in question.

c) they shoudn't be taken to imply that champagnes from the Maisons are intrinsically of 'better' quality that from the other two categories. The higher prices for the Maisons are probably due to the fact that the Maisons are more skilled and more effective at marketing their brands.

These increases in average prices were driven partly by the necessity of passing on increases in the grapes price and of raw materials in general and more significantly by a deliberate policy of what is called ‘premiumisation’

Putting price up when sales are going down may seem to be contradictory and in many industries, it would be just that. However, it is always worth bearing in mind what the president of one of the major trade bodies in Champagne said recently:

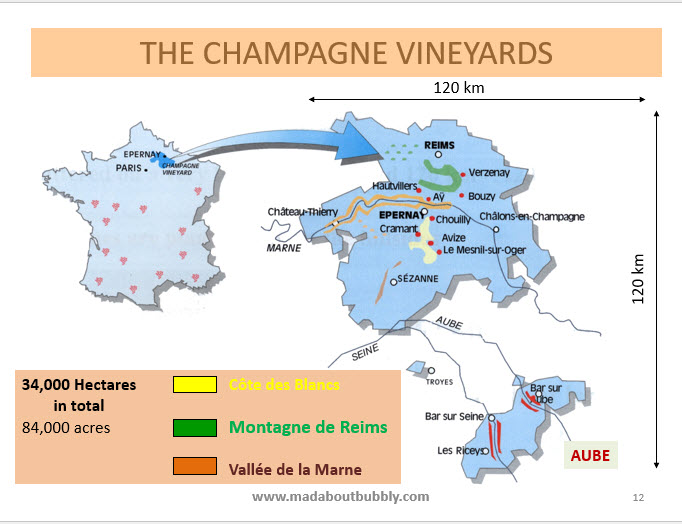

Champagne is produced from a limited geographic area according to strict production regulations which simply do not permit us to sustain rapid increases in volume.

Given this background is it quite logical to pursue a high value strategy and one should not expect prices to come down anytime soon.

Where do the best sales opportunities lie?

This is of course, the age-old questions that has no correct answer.

Is it the country with the greatest number of imports and where the value of imports is highest?

Is it in the countries that import only modest amounts of champagne but which may, in percentage terms at least, offer the biggest growth potential?

Then there are other things to consider such as political stability, population growth and many other factors. As Charles de Gaulle once apparently said in the form of a very back-handed compliment

“Brazil is the country of the future… and always will be”

Whatever you own views may be, one essential consideration is to have some data on which to base one’s estimates and calculations and to help in your deliberations.

You can find the full 2023 shipment volumes and value for 150 countries by clicking on this link.

Opportunities in Africa

For anyone assessing the market in Africa, a recent study by BusinessDay gives some useful data.

There are 5 principal champagne importing countries in Africa:

South Africa,

Côte d’Ivoire,

Democratic Republic of Congo,

Nigeria and

Morocco

However, shipments to Nigeria took a significant knock in 2023 – falling by more than 50% in fact – due to high inflation and devaluation of the currency. Nevertheless, there is clearly a demand in Nigeria and if the current economic issues are overcome one expects that shipments might rebound quite quickly.

Here’s a table showing the volume and value figures for the 9 leading champagne markets in Africa

Performance by style of champagne

Over the course of 2023 a few trends emerged regarding shipments of the various styles of champagne

Unsurprisingly, brut non-vintage champagne – what the Champenois call BSA or Brut sans Année because it is a blend of wines from several different harvest rather than from just one harvest – fell 8.6%

Is this a disaster signalling a terminal decline in popularity for this style of champagne?

Not really, in my view. After all, BSA still commands 76% share of all champagne shipped and the slight decline in volume rather reflects a growing awareness amongst consumers that other styles of champagne exist and are worth trying and also due to an effort amongst producers to promote different styles that command a slightly higher price.

On the other hand, shipments of Rosé champagne fell by quite a significant 17.2 % in 2023

On the face of it that looks discouraging, but in fact shipments have only returned to the level they were at in 2019 before the three years chaos that followed. It might be more accurate to say that it was the boom in shipment of Rosé over the past few years that was the exception rather than the rule.

Shipments of what are called Prestige cuvées performed relatively well in 2023 : they fell just 6.1% – a little less than BSA and Rosé but this is not surprising given the widespread efforts at premiumisation mentioned above.

(I have never met anyone who can give me a definition of a Prestige Cuvée, other than that it is more expensive and supposedly of better quality than the rest of the range. As far as I can tell there are no tangible criteria for a Prestige Cuvée and it can be whatever the producer says it is, so the term is not very helpful in my opinion).

In terms of the dosage, the results are a mixed bag

Overall shipments of low dosage champagnes decreased by 3.7 %, but in Italy and Germany shipments of the same style have seen a healthy increase.

In the UK and in Switzerland it was higher dosage champagne that saw the best gains.

Interesting as these figures are, I wouldn’t base my marketing strategy on just one year’s result. I suggest that it is far more relevant and revealing to study your target consumers and try to understand what they want. This can and does vary from one country to the next and even from one region or city to the next, but there’s no substitute to knowing your customers.

I hope you’ve enjoyed this round-up of news from Champagne.

If you have any questions or comments, or if you'd like to discuss a new project you are cnsidering, please email me at This email address is being protected from spambots. You need JavaScript enabled to view it.

All the best

Source : Comité Champagne unless mentioned otherwise.

On the demand side, the are signs of that some consumers are reducing the frequency of their champagne purchases and, in some cases, changing to other sparkling wines entirely– one only has to look at the plethora of sparkling wine brands on the market and their almost ubiquitous distribution to appreciate that champagne faces serious and growing competition amongst a certain segment of consumers.

On the demand side, the are signs of that some consumers are reducing the frequency of their champagne purchases and, in some cases, changing to other sparkling wines entirely– one only has to look at the plethora of sparkling wine brands on the market and their almost ubiquitous distribution to appreciate that champagne faces serious and growing competition amongst a certain segment of consumers.

Regular readers of this bulletin will remember how often I have mentioned the shortage of stock that resulted from two small harvests in 2020 and 2021 coupled with a big increase in demand since the end of the worldwide health incident.

Regular readers of this bulletin will remember how often I have mentioned the shortage of stock that resulted from two small harvests in 2020 and 2021 coupled with a big increase in demand since the end of the worldwide health incident. The obvious and simple answer is that they have responded by increasing prices.

The obvious and simple answer is that they have responded by increasing prices.