CHAMPAGNE BULLETIN SEPTEMBER 2022

In this month’s Champagne Bulletin

- Setting Retail pricing – a science or a shot in the dark?

- What exactly is a Private Brand?

- New champagne brand releases

- Direct to Consumer sales – Some pros and cons

- Harvest 2022 – a note of caution

How do you set the Recommended Retail Price for your brand?

This can seem like a very big question; there are so many factors that influence the price that the subject can seem bewilderingly complex.

- What are my costs

- What margin do I want to / need to make?

- Should my brand be more expensive or less expensive than brands already in the market?

- How many bottles do I want to / need to sell to meet your objectives?

to name but a few,

It’s certainly an important question so I don’t want to make light of it, but it’s important, in my view, to remember that there are no hard and fast rules about pricing and you may have more flexibility than you imagine.

Unless you’re dealing with a monopoly such as in Canada, there’s no set formula that says that if your cost is X then your retail price must be Y. You can charge whatever you want provided that you can justify the price you’re asking.

Take the case of this wine maker in Italy for example:

Credit: Facebook/ Via Maria 10

Tullio Masoni claims to have the smallest vineyard in the world. It’s on the rooftop of his apartment in the Reggio Emilia district and yields just 29 bottles of red wine per year.

With such a limited production you’d expect the price to be fairly high, but $5,000 USD per bottle does seem to be a little on the steep side! Nevertheless, that’s the price Sig. Masoni is asking for a bottle of his wine.

At that price you’d expect it to be something very special, and to attract the attention of wine experts everywhere, anxious to taste this marvel, but the risk with that is that any adverse opinion would cast serious doubt on the price. No need for Sig. Masoni to worry about that however – he says that his wine is not meant for drinking.

I’m not sure whether to put this down to Sig. Masoni’s unshakable confidence (arrogance?) or to concede that he has found the most brilliant marketing strategy ever, but it all goes to show that you can demand whatever price you want and some people, somewhere, sometimes will pay it.

Read on to the section below about new brands for another example of ‘creative’ retail pricing.

What’s the difference between a Personalised Label and a Private Brand?

Every industry has its own vocabulary and Champagne is no different, so perhaps it would be helpful to clarify some of them as it relates to creating your own brand.

Personalised Labels are mostly commonly found on wine gift web sites.

At the simplest level the gift company has a stock of bottles that it has already purchased from a champagne maker and you, the customer, can choose from a selection of template labels into which you can insert your choice of text/logo/image etc. These labels can look very simple and cheap or, depending on the company you’re dealing with, can occasionally look a little more professional, but they can rarely, if ever, be called stylish or elegant.

The customer has no control over any other aspect of the packaging, nor over the choice of champagne which, as mentioned above, has already been purchased by the gift company.

Importantly, the customer does not own the brand name which remains the property of the champagne maker and his or her name features prominently on the label.

Some more specialist suppliers offer the customer the chance to design their own labels and this is certainly a big step up from the template labels on offer at the lower end of the market. Nevertheless, the customer will not have much, if any, say over the rest of the packaging nor over the choice of champagne which, as mentioned above, will have been pre-selected by the supplier.

What uses are Personalised labels suited for?

They are ideal for private or corporate gifts because of the novelty factor, the relatively low cost and of course the opportunity they provide to promote a company or product.

They are not suitable, in my opinion, as the foundation of a champagne business because of all the drawbacks mentioned above.

On the other hand, they can be effective to raise funds for charitable causes. Two excellent examples of this type of use are the champagnes endorsed by Roger Daltry to support Teen Cancer America and more recently the champagne launched to support the Royal British Legion which is an organisation that supports armed forces veterans.

On the other hand, they can be effective to raise funds for charitable causes. Two excellent examples of this type of use are the champagnes endorsed by Roger Daltry to support Teen Cancer America and more recently the champagne launched to support the Royal British Legion which is an organisation that supports armed forces veterans.

The arrangement about the respective share of the profits from sales is a matter between the charity concerned and the supplier, but the brand name never belongs to the charity.

Private Brands

There are several words that crop up.

Sometimes they are referred to as ‘White Label’ brands or ‘Buyer’s Own Brands’ (BoB), but I am not a fan of ether of these terms because, in my experience, the objective of such projects is to buy at the lowest possible cost and in large quantities so as to promote the end product as a ‘Bargain’ product in supermarkets and similar retail outlets. To meet this objective, the packaging is usually simple and inexpensive, although it can be attractive, and the champagne is rarely of top quality, although there are a few exceptions.

In some instances, the brand actually belongs to the customer, but in others, the brand remains the property of the champagne maker who produces on behalf of the buyer. In these cases, the customer may choose to protect their position by agreeing with the champagne maker that this particular brand will be supplied exclusively to the customer in question and to no one else.

Many supermarket brands fall into this category

I admit that the term Private Brand is my own invention because it describes the sort of exclusivity and quality that is needed, in my view, if the intention of the brand creator is to build a business based on brand equity and image.

This is not to say that Private Brand champagne has to be disproportionately more expensive than others - excellent quality can be found at reasonable prices.

The great advantage of a Private Brand is, as the name implies, that the brand name belongs to the customer and name is registered in his or her name with the authorities in Champagne. In addition, customers who choose a Private Brand usually wish to have more control over all aspects of the packaging and are looking for something more distinctive in terms of packaging.

Most important of all is that fact that the fruits of success, if and when it comes, all revert to the brand owner.

New Brands

Two new champagne brands were launched recently in the USA.

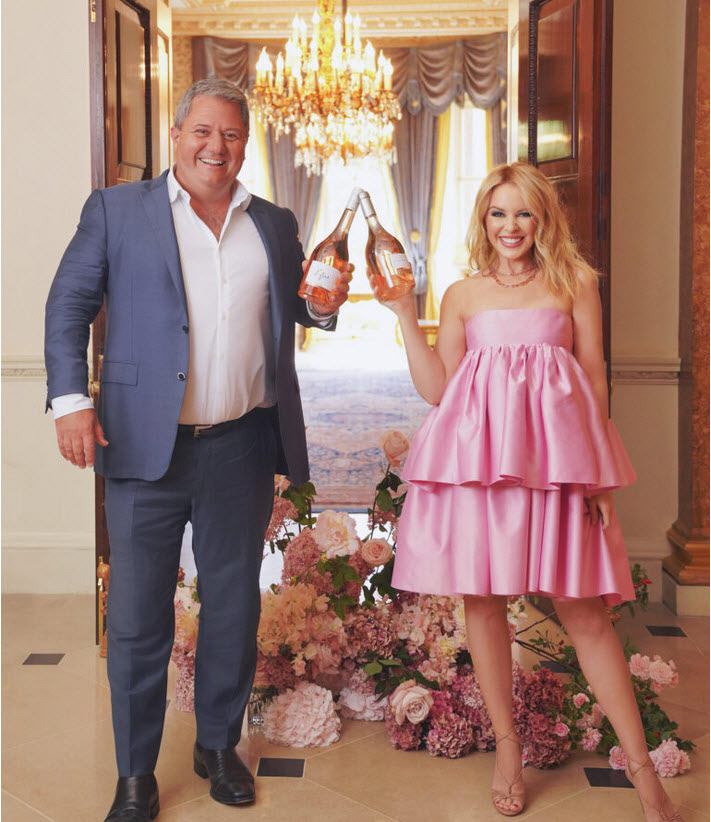

The first is another celebrity brand of the type seen over recent years across the whole spectrum of wine and spirits. In this instance it’s Scott Disick who is the personality behind the brand. For those of you who haven’t heard of Scott Disick ,he is the former partner of Kourtney Kardashian and regularly appears on TV in the US.

The first is another celebrity brand of the type seen over recent years across the whole spectrum of wine and spirits. In this instance it’s Scott Disick who is the personality behind the brand. For those of you who haven’t heard of Scott Disick ,he is the former partner of Kourtney Kardashian and regularly appears on TV in the US.

The champagne is made by a company located not far from Reims and one which I know quite well; I have introduced several clients to the same produce over the past year or two.

I am however surprised to read that the mission of this new brand is, according to one of the co-founders “ to bring quality and innovation in the Champagne/sparkling wine category”

Apart from the packaging, which is admittedly quite eye-catching, it’s not obvious to me how this champagne brings innovation to the category.

In addition, the retail price of $150 per bottle seems hard to justify given what I know about the maker of the champagne, unless of course Mr. Disick is using the same sort of marketing strategy as Sig. Masoni above.

The second new brand is much more interesting in my view.

It’s called Rendez-vous and has been launched under the brand name Diane Salem by co-founder Fiona Perrin, a French woman who has lived in the USA for many years.

It’s called Rendez-vous and has been launched under the brand name Diane Salem by co-founder Fiona Perrin, a French woman who has lived in the USA for many years.

The brand offers a few interesting ideas that I feel, form a more solid basis for marketing than the attributes proposed by Mr. Disick’s brand, although they’re not entirely convincing.

Rendez-vous is said to be ‘natural and vegetarian - claims that are easy to make but for which no evidence is presented. Indeed, the same claim could be made for many champagnes these days.

More interesting is the fact that the accent is very much on the fact that this is pitched as a brand for women who are undoubtedly very influential in consumers’ decision about whether to choose champagne or some other drink. Ms Perrin emphasises the fact that she is not a native of Champagne and that she has had to build her network from scratch over many years.

In contrast to Mr. Disick’s champagne, Rendez-vous will be retailed at about $50 USD. It’s hard, to say the least, to understand exactly what can justify the disparity in price between the two new brands but my guess is that the target consumers are very different and that just goes to show that there will always be customers at any price point if you know where to find them and what they are looking for.

Rendez-vous is apparently an organically produced champagne and consequently is made in relatively small quantities, so sales targets are also modest in scale. My understanding is that Rendez-vous will be sold exclusively online which leads nicely on to the next topic.

Direct to consumer sales

Whatever type of champagne you wish to create, the fact remains that the bottles produced must be sold.

Traditionally the point of sale would be a wine shop, a bar, a restaurant, or a hotel. However, since the advent of the internet it has been much easier to sell directly to the final consumer. This is the term usually applied to sales direct from the wine maker to the customer, but since such sales are invariably made on-line, the term also applies to all on-line sales.

This distribution channel which started as something of a novelty, is now assuming very significant proportions. During lockdowns Direct to Consumer (DtC ) sales took on a critical importance for many wine producers and DtC has become established as an indispensable part of every marketing and sales plan in most global markets including the U.K.

Sales of English wine increased by 69% in the period 2019 to 2021 and again by 31% in 2021. In the same two-year period DtC sales grew by 265% and the channel accounted for 57% of all sales in 2021, up from 36% in 2019.

Source*Wine GB

In the USA the story is much the same, except on a far larger scale

According to Statista, the total value of DtC shipments in the USA reached 4.2 billion USD in 2021.

As mentioned above, lockdowns had a significant impact on DtC sales because for many months people couldn’t go out to their favourite bar or restaurant and instead ordered wine to enjoy at home, so as things get back to normal, we shouldn’t expect this fast rate of DtC sales growth to continue.

As mentioned above, lockdowns had a significant impact on DtC sales because for many months people couldn’t go out to their favourite bar or restaurant and instead ordered wine to enjoy at home, so as things get back to normal, we shouldn’t expect this fast rate of DtC sales growth to continue.

Interestingly it wasn’t only sales volume that grew over the past couple of years, the value per bottle also increased: by a record 11.8% to $41.16 per bottle ( again as reported by Statista)

Another important attraction about DtC sales is that you are paid before the bottle is despatched to the customer and paid the full retail price. This is in marked contrast to the situation with bars and restaurants that pay wholesale prices and demand generous credit terms.

So, what’s not to like about DtC sales?

Well, there’s an old adage inn the wine business that you build brand image and reputation in the on-trade (bars, clubs hotels and restaurants) and you build volume in the off-trade (wine shops and supermarkets) but you do things in that order: on-trade first and then off-trade.

The difficulty about Dtc is that people are reluctant to purchase wines on-line that they have never tasted or never heard of, and the on-trade is usually the place where people first experience a brand.

This reluctance to try new brands can be overcome with great on-line marketing and by personal recommendation from a friend, colleague or influencer – that’s where celebrity endorsement comes in – but something about the brand has to tempt the consumer to get their bank card out and make the initial purchase on-line.

Finally, on a note of optimism tinged by a little caution…

2022 Champagne harvest double last year’s

You will have read already about the booming sales of champagne over the past year and the consequent shortage of stock. Worries about being able to meet the burgeoning demand meant that there was a lot riding on this year’s harvest, so it was very welcome news to learn that it was an excellent harvest in terms of quality and quantity, and much is being made of the fact that this year’s harvest was double the size of last year’s.

That is, of course, great news and a catchy headline, but before we all get carried away and think that pressures on pricing will ease immediately, don’t forget that a) last year’s harvest was awful so a harvest of double that size is still not extraordinary, b) it will be a few years yet before the wines from this year’s crop actually make it into the market, so caution and modest expectation will remain the watchwords for a while longer yet.

---

As ever, if you have any comments or questions about this month’s bulletin, please send me an email to This email address is being protected from spambots. You need JavaScript enabled to view it. and I’ll do my best to answer promptly.

In case you’ve never heard of Champagne Day, it started over a decade ago, as an online only event for champagne lovers who wanted to share their enthusiasm with like-minded people around the world. That’s still the central theme to the event, but now it has given rise to loads of spin-off events both on and off-line, to celebrate and share champagne and to get people talking about champagne

In case you’ve never heard of Champagne Day, it started over a decade ago, as an online only event for champagne lovers who wanted to share their enthusiasm with like-minded people around the world. That’s still the central theme to the event, but now it has given rise to loads of spin-off events both on and off-line, to celebrate and share champagne and to get people talking about champagne This short phrase may strike you as a bit flippant, but there is a lot of wisdom contained in these few words and they underline the fact that in the champagne business, patience is not just a virtue, it’s an essential.

This short phrase may strike you as a bit flippant, but there is a lot of wisdom contained in these few words and they underline the fact that in the champagne business, patience is not just a virtue, it’s an essential.

On the other hand, they can be effective to raise funds for charitable causes. Two excellent examples of this type of use are the champagnes endorsed by Roger Daltry to support Teen Cancer America and more recently the champagne launched to support the Royal British Legion which is an organisation that supports armed forces veterans.

On the other hand, they can be effective to raise funds for charitable causes. Two excellent examples of this type of use are the champagnes endorsed by Roger Daltry to support Teen Cancer America and more recently the champagne launched to support the Royal British Legion which is an organisation that supports armed forces veterans. The first is another celebrity brand of the type seen over recent years across the whole spectrum of wine and spirits. In this instance it’s Scott Disick who is the personality behind the brand. For those of you who haven’t heard of Scott Disick ,he is the former partner of Kourtney Kardashian and regularly appears on TV in the US.

The first is another celebrity brand of the type seen over recent years across the whole spectrum of wine and spirits. In this instance it’s Scott Disick who is the personality behind the brand. For those of you who haven’t heard of Scott Disick ,he is the former partner of Kourtney Kardashian and regularly appears on TV in the US. It’s called Rendez-vous and has been launched under the brand name Diane Salem by co-founder Fiona Perrin, a French woman who has lived in the USA for many years.

It’s called Rendez-vous and has been launched under the brand name Diane Salem by co-founder Fiona Perrin, a French woman who has lived in the USA for many years. As mentioned above, lockdowns had a significant impact on DtC sales because for many months people couldn’t go out to their favourite bar or restaurant and instead ordered wine to enjoy at home, so as things get back to normal, we shouldn’t expect this fast rate of DtC sales growth to continue.

As mentioned above, lockdowns had a significant impact on DtC sales because for many months people couldn’t go out to their favourite bar or restaurant and instead ordered wine to enjoy at home, so as things get back to normal, we shouldn’t expect this fast rate of DtC sales growth to continue. Well, for a moment or two in the run-up to the harvest, it looked as though a very rare beast indeed was about to make an appearance: the happy vigneron.

Well, for a moment or two in the run-up to the harvest, it looked as though a very rare beast indeed was about to make an appearance: the happy vigneron. One of the most critical factors in making, marketing and selling champagne is the importance of forecasting. In fact, this cannot be emphasised enough

One of the most critical factors in making, marketing and selling champagne is the importance of forecasting. In fact, this cannot be emphasised enough A few days ago, I came across an article that at first, I thought had no relevance whatsoever for the champagne business and even less for anyone who planning to create a private champagne brand. However, on reflection I realised that the article highlighted one really important principle about launching any new brand, including a private champagne brand.

A few days ago, I came across an article that at first, I thought had no relevance whatsoever for the champagne business and even less for anyone who planning to create a private champagne brand. However, on reflection I realised that the article highlighted one really important principle about launching any new brand, including a private champagne brand. Coming after two pretty dismal years in 2019 and 2020, the news was greeted with much celebration and confidence that Champagne had turned the corner and was once again on the path towards buoyant sales and decent profits, but even the most bullish champagne makers would probably be surprised by a recent study that forecasts that the value of the Champagne market will keep on powering ahead in the next 10 years.

Coming after two pretty dismal years in 2019 and 2020, the news was greeted with much celebration and confidence that Champagne had turned the corner and was once again on the path towards buoyant sales and decent profits, but even the most bullish champagne makers would probably be surprised by a recent study that forecasts that the value of the Champagne market will keep on powering ahead in the next 10 years. Another significant issue is transport, particularly sea freight

Another significant issue is transport, particularly sea freight Image from the Instagram account of Champagne Avenue Foch

Image from the Instagram account of Champagne Avenue Foch With demand for Champagne unexpectedly booming since mid-2021, stocks of bottles in cellars across the region are disappearing rapidly because there are too few bottles to replace them after a combination of appalling weather in 2021 and what many say was a strategical error in 2020 which led to both harvests being very small.

With demand for Champagne unexpectedly booming since mid-2021, stocks of bottles in cellars across the region are disappearing rapidly because there are too few bottles to replace them after a combination of appalling weather in 2021 and what many say was a strategical error in 2020 which led to both harvests being very small.

Faced with this complex situation and many heterogeneous interests, one organisation, Les Vignerons Indépendents de Champagne has already put forward some innovative proposals that, they say, take a more sensible long-term view rather than just looking at supply and demand over a short period.

Faced with this complex situation and many heterogeneous interests, one organisation, Les Vignerons Indépendents de Champagne has already put forward some innovative proposals that, they say, take a more sensible long-term view rather than just looking at supply and demand over a short period.