CHAMPAGNE BULLETIN MAY 2022

Hello and welcome to the May edition of the Champagne Bulletin

In this month’s bulletin…

-

Ever thought of buying vineyards in Champagne? This bulletin will definitely be of interest to you.

-

Wondering which markets are showing the greatest potential for champagne right now? Read on to find out more.

-

Creating your own champagne brand. Time spent at the outset in clarifying your objectives will save time and expense later.

Vineyards in Champagne

Every client who contacts me about creating a champagne brand has a different vision and each one has a different time scale in mind to complete the project. I usually tell them that the project will take about a year. For some people that’s too long, but other people take a very different view and want to go right back to basics by buying vineyards.

If that’s you, I have some good news and some not-so-good news for you.

Taking the bad news first: the cost of vineyards in Champagne is amongst the highest in the world; so high, in fact, that for a newcomer to the industry, making a return on your investment is likely to take a (prohibitively?) long time.

On the positive side, prices are coming down, but before you get your cheque book out, let’s take a closer look at those prices.

Champagne covers several separate administrative areas or départements and 3 of these are distinguished in the latest report on vineyard prices*.

At the least expensive end of the scale is the area called the Aisne which lies to the north-west of Reims. The vineyards here are not ranked amongst the cream of the crop but they can nevertheless produce good quality grapes. The average price per hectare in the Aisne region in 2021 was 814,000 euros. (down 4% versus 2020)

Slightly more expensive was the average price in the Aube region which is some 100 kilometres south of Reims and is centered close to the town of Troyes

The Aube plays a significant role in Champagne. It’s a large area that is particularly suited for Pinot Noir grapes which are increasingly sought after by the major brands, partly because the price of the grapes is less than in the more prestigious areas nearer to Reims and Epernay

On average, a hectare of vineyards in the Aube in 2021 would have set you back 888,000 euros (down 5% versus 2020)

The third area covered by the report is the Marne which includes most of the vineyards around the twin centres of Champagne: Reims and Epernay.

Here the average price per hectare in 2021 was 1.128 million euros which is (6% down versus 2022)

Be aware though, that the fall in the average price per hectare hides the fact that the prices in the best Premier and Grand Cru villages have hardy moved at all and in La Côte des Blancs, the best plots actually increased in price.

Generally speaking, buying vineyards in Champagne with a view to creating a new brand is a costly and lengthy affair and is not something that I usually recommend. There are other ways to create a new brand and if you’d like to know more about that, don’t hesitate to contact me

*Source SAFER (Société d’aménagement foncier et d’établissement rural)

Annual report gives details about last year’s unexpected demand for champagne

The latest report on the state of the Champagne market (*2) in 2021 shows strong increases almost everywhere particularly in terms of value. In the current circumstances of strong demand on the back of tight supply following two small harvests, adding value is definitely the name of the game.

It probably won’t surprise you that the USA is the largest market in terms of volume as well as value (34 million bottles for a total value of 793 million euros)

The next 4 or 5 largest markets are shown in chart A below and it’s interesting to note, if you do a very rough calculation (divide the value by the number of bottles), how much higher the price per bottle is in the USA and Japan than in the other markets.

Despite the different value per bottle generated from market to market, the overall trend is very much towards higher prices

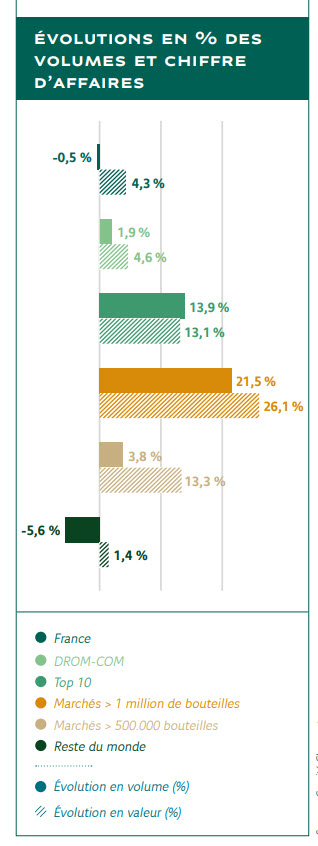

In chart B below change in volume is shown in the block bars and change in value in the hatched bars and as you can see, even in markets where volume fell, the value still increased.

Apart from the leading markets shown in chart 1, there has been a surge in demand in many other countries

Norway + 58% versus 2021

Denmark + 37%

Sweden + 11%

and further afield

South Korea + 54%

and

New Zealand + 47%

Both of which imported over 1 million bottles in 2021, a target also surpassed by South Africa which is the biggest champagne market in Africa

It’s worth noting as well that shipments to the United Arab Emirates jumped 71% in value in 2021 versus 2020 to reach a total of 31 million euros, putting the UAE in 19th position in the world for value.

In other market news, outside France, Brut non-vintage accounted for 77% of volume but only 64% of value, whilst in contrast, Rosé champagne took 11% of volume and 13% of value and Prestige Cuvée accounted for just 5% of volume but 16% of value.

*2 All data from the Comité Champagne

Setting clear objectives for a new brand

As mentioned above, the talk in Champagne at the moment is all about how to add value. Even the smaller brands are changing their attitude. Whereas in the past they may have chased volume, these days more and more producers recognise that adding value and raising prices is the way to go.

Consequently, there are fewer opportunities for launching new brands at the low end of the market and correspondingly more at higher price points provided that the strategy has been well thought-out.

The producers who are willing to create brands for third party customers increasingly want to know more about the buyer to ensure that their champagne is in good hands

For this reason, time spent in the early stages of a new brand project to gain clarity on the objectives in terms of volume and value, style of champagne, target market and distribution is time well spent because it helps to avoid costly mistakes and changes of direction later.

To discuss these issues and others related to creating a private brand, email me at This email address is being protected from spambots. You need JavaScript enabled to view it.

The champagne market is particularly dynamic at the moment with growing demand chasing limited supply. All thoughts now are turning to this year’s harvest. If it’s of good quality and above all, abundant, there will be sighs of relief because stocks can gradually be built back up to what is considered to be normal levels at around 3 times annual sales.

On the other hand, another small harvest would make a tight situation even more difficult. The next couple of months will be crucial and you will be able to follow developments in the next few Champagne Bulletins.

Until next month…

JH