CHAMPAGNE BULLETIN APRIL 2022

This month the CIVC published the official shipment and market figures for 2021 and there is plenty of interesting material to read with the US consolidating its No. 1 position for champagne in terms of bottles shipped and total value, ahead of the U.K. with many other markets showing very strong growth.

In addition, since many readers are interested in launching their own brand of champagne, we take a look at a success story for a relatively new brand in the USA and ask what lessons there are to learn for future new entrants.

USA champagne market on a roll

It’s a few years since the USA surpassed the UK as the biggest export market for champagne and in 2021 it consolidated the No.1 position with sales volume increasing to 34.1 million bottles and sales value growing to 938.7 million US dollars.

The rebound in both volume and value versus 2020 was to be expected since there was so much disruption in that year, but the 2021 figures show big increases versus 2019 as well. What’s more, the trend is the same in many other markets with the UK, Spain, Italy and Holland returning very strong growth figures too.

However, because many of the readers of this bulletin are based in the USA, as are the majority of people who contact me about creating their own brand of champagne, let’s stay focused on the USA .

All the figures in the table below are expressed in thousands of 9-litre cases (a 9-litre case holds 12 x 75cl bottles)

You’ll see that the Moet Hennessy group which owns Veuve Clicquot, Moet & Chandon, dominates the market and if you add in Dom Perignon which is also part of the MH stable, the group’s market share is +/- 46%

You’ll see that the Moet Hennessy group which owns Veuve Clicquot, Moet & Chandon, dominates the market and if you add in Dom Perignon which is also part of the MH stable, the group’s market share is +/- 46%

it is undeniable that the US market, like most others, is dominated by big, established brands, but the good news for challenger brands is that over 50% of the market is potentially available for other brands and that thought leads us nicely on to the second topic of this month’s bulletin

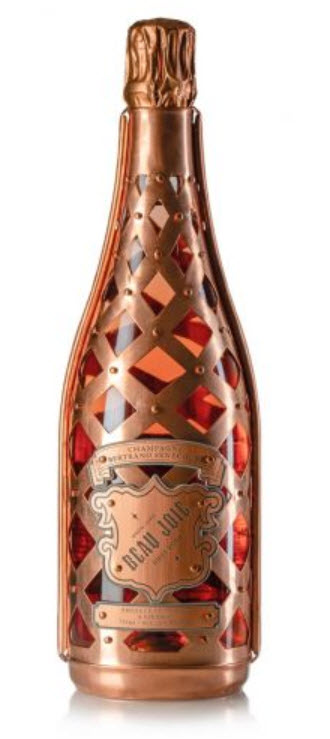

Beau Joie – Brand profile

Just missing out on the table of best-selling brands shown above is a relative newcomer by the name of Champagne Beau Joie ( http://www.beaujoiechampagne.com/) which according to Impact Data Bank – one of the definitive sources of information about the drinks business – enjoyed growth of 65% in 2021 and sales of 20,000 x 9 litre cases – that’s 240,000 bottles - to break into the top 20 best-selling champagnes in the USA.

Let’s take a closer look at this brand and hazard a few educated guesses about some of the secrets of its success.

The brand was created back in 2011 Jon and Brandis Deitelbaum of Toast Spirits in Las Vegas.

Although that’s not long ago at all compared with most of the famous champagne houses that count their history in centuries, not decades, it’s still 10 long years of effort and investment, but building a brand is not usually a short, get-rich-quick project.

The champagne is made by Champagne Bertrand Senecourt based in Epernay, which was itself only founded in 1972 by Champagne Charles Ellner. These are respectable houses, but nothing more; they don’t have the same caché of a small boutique winery (which couldn’t produce the necessary volumes anyway) nor the glamorous history of the more famous names.

If you look on some of the wine review web sites, you probably won’t find remarkably high scores for Beau Joie, so the success must be due to other factors, so what have they done right? Here are some suggestions:

Plenty of investment: According to Crunchbase.com , the brand has raised some 19 million in investments over the years. Of course, it is possible to start with more modest funds, but the bigger your ambitions for the brand, the greater the investment needed, particularly if your goal is to grow it to a quarter of a million bottles and beyond (and that’s just in the USA).

Unique positioning: the brand story is woven around the days of knights in armour and of chivalry.

For many people that will not appeal at all, but it’s a niche that Beau Joie has successfully taken over as its very own. It’s recognisable and distinct.

Clear targeting: Interestingly enough, there is almost no mention at all on the Beau Joie web site of the contents of the bottle, nor of the vineyards and history of the brand (there is none, in fact, since it was only founded in 2011).

Equally there is no mention of medals, awards and high scores in wine competitions. This implies to me that Beau Joie knows exactly who its target consumers are and recognises that they are not wine experts who want to know the finer details of the wine itself. This is not a problem because this type of consumer represents the huge majority of the market.

Innovative packaging: taking about being distinctive, all Beau Joie bottles are wrapped in a copper cage evoking a suit of armour. Like it or not, this creates a striking visual impact and instant brand recognition.

Brut non-vintage

Rosé

Brand Endorsement: Beau Joie has an association with the Golden Knights ice hockey team in Las Vegas and has attracted investment from well-known figures in the music industry.

Distribution: No matter how good a wine may be, if it is not available in all the right places in all the right cities, sales will never grow to any significant extent. Beau Joie is distributed by some of the most powerful distribution companies in the USA. They may have been impressed by the strong brand identity and unique positioning strategy developed by Beau Joie.

A quick search on the internet reveals that Beau Joie is available in a whole host of locations throughout the USA and elsewhere including some of the biggest retail outlets.

Pricing: The non-vintage offering which is always the mainstay of any range, is priced at $99 USD and the rosé at $129; both prices considerably above the mid-range of the market where the most famous brands and the fiercest competition can be found.

This prestige positioning offers larger profit margins to fund investment and positions the brand as a cut above the average.

JH: apparently a lower priced addition to the range at $49 is under consideration. In my opinion, this poses quite a risk to the current premium positioning which is already successful (if it ain’t broke, don’t fix it) and in addition, you have to sell a lot of bottles at $49 to generate a profit, but if the distribution network is powerful enough, perhaps those large sales volumes are attainable.

But that’s just my opinion. What do you think? Let me know by email.

That concludes this month’s Champagne Bulletin.

See you again in a month’s time and meanwhile, you can contact me at This email address is being protected from spambots. You need JavaScript enabled to view it.