Champagne Bulletin February 2022

A fundamental shift in strategy for Champagne?

There have been a lot of superlatives coming out of Champagne in the past few weeks which is welcome news for champagne producers. However, there’s always more to learn than meets the eye, so in this month’s Champagne Bulletin let’s look at some of the possible implications behind the headlines.

It’s quite a long and intricate story but if you read to the end, I think it will give you a very valuable insight into the champagne industry and what to expect in the years ahead.

---

An unexpected rebound in sales

By any measure, the recovery in sales of champagne after the most severe of the health restrictions were dropped, has been spectacular. Not only did the number of bottles shipped in 2021 jump back up to 322 million bottles from just 245 million in 2020 – that’s an increase of over 30% - it was up 8% over 2019 which was the last comparable year.

Even more remarkable was the fact that the value of champagne shipped in 2021 hit an all-time high of 5.7 billion euros

To make things even better, at least from the point of view of champagne makers, the average price per bottle also increased and did so by far more than one would expect simply as a result of the expected annual increases.

So, what’s going on and does this trend mark a fundamental shift in outlook on the part of the champagne industry as at least one commentator* has suggested?

To get a clearer view of the situation let’s first look at the relevant figures in more detail.

*Martin Cubertafond – consultant in food and wine distribution strategy at Sciences Po

Leading markets

The bulk of the increase was accounted for by shipments to export markets and in fact the results for the French market were just about static compared to 2019

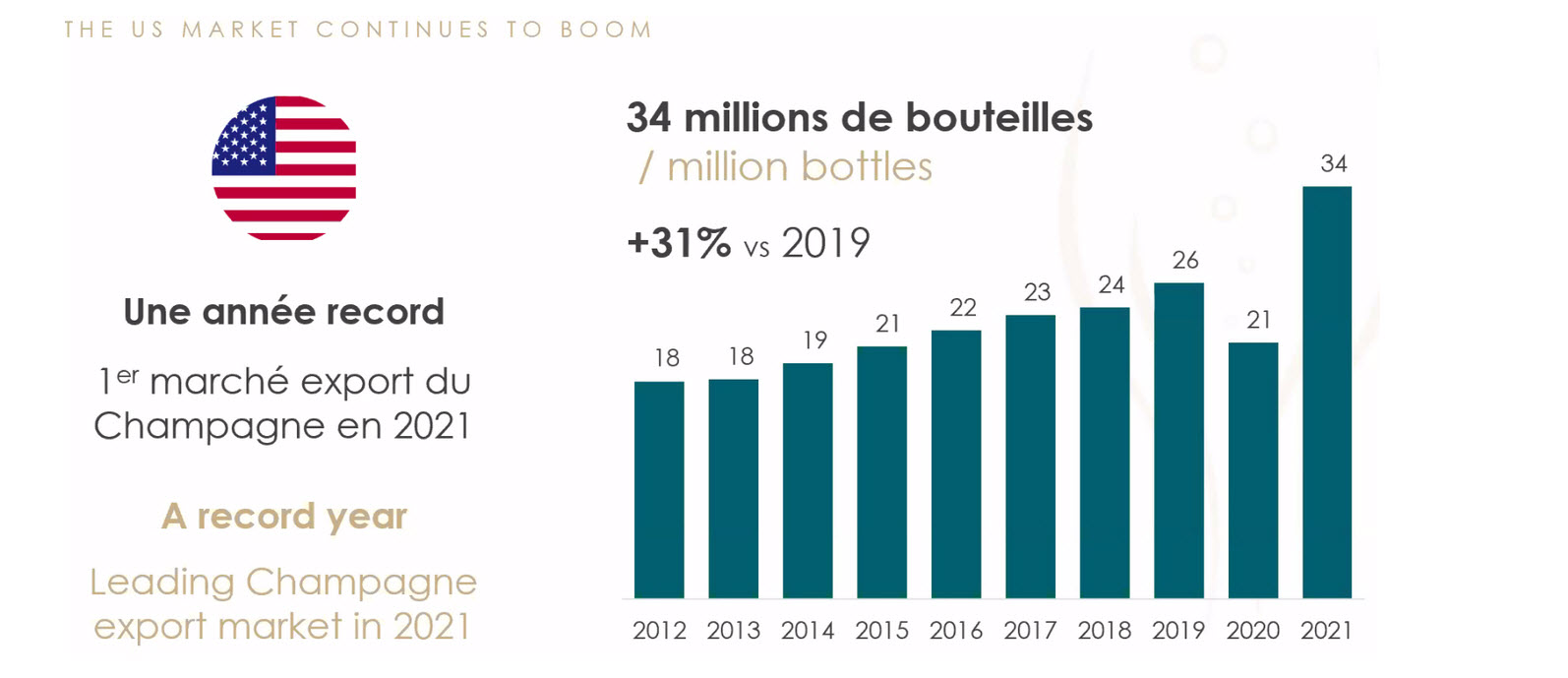

The USA is now biggest market in volume after overtaking the UK in 2021. The USA had already taken the No. 1 spot for value a few years ago.

Having said this, the UK - former number 1 market for both volume and value- also saw a huge rebound and higher average prices in 2021

The upward trend continued in many other export markets, and it is obvious that the world still loves champagne despite the plethora of good sparkling wines available from elsewhere.

At first sight, one might think that this resurgence in the number of bottles shipped would be the cause of unmitigated celebration all round, but that’s true only up to a point because it’s giving rise to a discussion that could shape the strategy of the champagne trade for many years to come.

It’s all to do with managing supply and demand and to understand this, we need to consider the background.

Supply and demand

Champagne is made in a limited geographical area which has the potential to produce somewhere in the region of 340 million bottles at maximum capacity. Here have been many discussions in the past about increasing the size of the appellation – the designated area in which Champagne can be produced and/or increasing the maximum allowed yield per hectare – but this is fraught with difficulties related to

a) maintaining the high quality of the wine, on which the whole image of Champagne is founded, if new plantings on potentially inferior soils were permitted and

a) maintaining the high quality of the wine, on which the whole image of Champagne is founded, if new plantings on potentially inferior soils were permitted and

b) environmental concerns which tend to suggest that focusing on increased production might be detrimental to responsible management of the land.

One of the strengths of Champagne over many decades has been the systems that are in place to ensure that supply is kept in line with demand.

In good times, the authorised yield per hectare for each year’s harvest can be increased to boost production to satisfy growing consumer demand.

Conversely, in periods of falling sales the authorised yield per hectare can be reduced to avoid excess stock building up in the cellars which, in turn, could lead to price discounting as stocks are sold off to provide cash flow.

Furthermore, behind the scenes in Champagne is the system of reserves which is the envy of other wine making regions. These reserves comprise stocks of still wine which are held in abeyance by each champagne maker only to be used, if authorised by the governing body, to make into champagne and thus overcome any temporary problems in the event of a particularly poor harvest.

Mistakes or just bad luck?

For many, many years these systems have worked extremely well to stabilise the champagne market, but the decisions (some would say, mistakes) made in 2020 and 2021 may yet bring about a major shift in the way champagne makers set their strategy. When I say ‘champagne makers’ I mean the big houses because, at least as regards sales, they set the tone and direction for everyone else to follow.

In early 2020 when the impact of the pandemic was beginning to be felt, many feared a catastrophic fall in champagne sales – down to just 200 million bottles according to the worst estimates - and the decision was taken to severely reduce the size of the authorised yield – the amount of grapes that could be harvested per hectare.

As it turned out the quality of the 2020 harvest was superb which left many champagne makers lamenting the fact that they weren’t allowed to pick all the grapes they would have wished and even the release of some of the famous ‘Reserve’ didn’t compensate adequately for this shortfall.

Sure enough, sales did decline, but not by as much as first feared, so stocks in the cellars remained at reasonable levels.

In the following year, 2021, the decision about the permitted size of the harvest was a difficult one for two reasons:

By mid-year there were very few signs of the rebound in sales that was to come in the second half of the year and in particularly in the last three months. Nevertheless, a decision about the size of the harvest had to be taken in late summer and taken without much visibility about how sales would recover.

In hindsight, the limit was fixed too low, but in many areas of Champagne, this didn’t really matter because the weather in 2021 was so bad that the size of the harvest was pitiful.

In hindsight, the limit was fixed too low, but in many areas of Champagne, this didn’t really matter because the weather in 2021 was so bad that the size of the harvest was pitiful.

The result was that stocks for many producers were left very low indeed at the end of 2021 and with sales going through the roof a new way had to be found to manage the situation.

This brings us back to the fact, noted above, that the average price per bottle of champagne went up significant in 2021

What next for prices and availability?

The conclusion that many people have come to is that the average price per bottle has increased because consumers are willing to pay a little more to get what they want, because they have gravitated towards slightly more expensive bottles and also because the limited supply at the end of 2021 meant that there were fewer discounted offers available – why discount a product if it’s in short supply?

This convergence of several factors is leading many players to shift from a strategy that focused on the demand for champagne and then tried to manage production in order to match the demand and consider instead a strategy of living with a stable supply and optimising the quality and price of that supply in such a way that demand falls in line with what the champagne house has to offer. Even if that demand is smaller or remains stable, the profitability of every bottle sold will be enhanced.

What’s the smart money doing?

If this plays out in the way outlined above, it’s likely that ex-cellar prices will increase at a faster rate than would otherwise be expected simply from annual inflation and this will inevitably feed through to consumer prices.

By the same token, this is likely to mean higher profits for established brands and for any emerging brand that can find its niche and a loyal following willing to pay the asking price for the brand they want.

What evidence is there that more and more champagne makers are adopting a more premium strategy?

Plenty if you look at some if the investments flowing into Champagne over the past couple of years:

- In 2020 the Campari group acquired a majority share in Champagne Lallier with the stated aim of moving the brand up-market

- In 2021 Rémy-Cointreau acquired a majority holding in Champagne J de Telmont

Both of these champagne houses were previously positioned as mid-range brands producing approximately 1 million bottles per year and both represented an opportunity for the buyer to gain a foothold in the champagne market. Neither purchaser would have made the acquisition if they did not see the chance to add value to the brand and increase profitability.

- Since then, LVMH has taken a 50% share in Champagne Armand de Brignac

More recently other well-known names from both within and outside the world of wine, appear to be betting on the future of premium champagne

More recently other well-known names from both within and outside the world of wine, appear to be betting on the future of premium champagne

- Leonardo di Caprio has also become an investor in Champagne de Telmont

- Artémis Domaines, a company owned by the Pinaud family that also owns Château Latour in Bordeaux and Clos du Tart in Bourgogne to name just a few of their premium winery holdings, has just announced an investment in Champagne Jacquesson

- Whilst Brad Pitt is a major shareholder in a project with Champagne Pierre Peters

This regular stream of high-profile investments in Champagne would suggest that the purchasers see opportunities to generate more profit and that generally means increased prices.

In summary then, Champagne seems to be at a pivotal point that signals a change in direction and an even greater focus on premiumisation and a willingness to forego sales volume in favour of sales value.

What this will mean for consumers and for the thousands of smaller and less well-resourced champagne producers that have nevertheless influenced the character of the land over many generations, remains to be seen with some of the consequences being predictable whilst others will be unexpected.

We’ll be looking at those in future Champagne Bulletins.

JH

February 28th 2022